Liquidity-Less Bridging+ Multi-Asset Stablecoins

Issue stablecoins backed by ANY asset: fiat currencies, precious metals (gold, silver, platinum), or custom asset classes. Deploy on any blockchain with burn-and-mint bridging and cross-asset FX.

Deploy on any network you need. Bridge USDC → Get EURZ on destination chain. Zero liquidity requirements.

Governed digital cash, made practical

Aryze provides technology and evidence. Issuance is performed by your licensed issuer; FX is priced/executed by your LPs; availability depends on jurisdiction, licensing and integrations.

Anything to Anything

Bridge AND convert in a single operation. Customer sends one asset, receives a different asset on a different chain. We handle the complexity.

USDC

Ethereum

EURZ

Polygon

Customer sends USDC on Ethereum, receives EURZ on Polygon

BTC

Bitcoin

Gold Token

Solana

Convert BTC to tokenized gold during cross-chain transfer

USDT

Avalanche

GBPZ

Arbitrum

Bridge and convert USDT → GBPZ in a single atomic operation

How It Works

- No wrapped tokens - native assets on every chain

- Zero liquidity requirements (burn-and-mint)

- Atomic cross-asset conversion during transit

- Any supported asset to any other asset

- Policy controls and audit trails for every step

Try It Yourself

Watch how our burn-and-mint bridge transfers assets across chains without locking liquidity.

Ethereum

Ready

Polygon

Waiting

Built for Your Business

Infinite-scale stablecoin infrastructure with burn-and-mint architecture and full regulatory compliance.

Stablecoin Infrastructure Results

Build compliant, scalable digital assets

Cross-chain transfers

vs traditional methods

Custom backing assets

Fully regulated

ARYZE vs Traditional Stablecoins

See how burn-and-mint compares to lock-and-mint bridges

| Feature | ARYZE | Circle (USDC) | Tether (USDT) | Traditional Bridges |

|---|---|---|---|---|

| Asset Support | ANY asset (EUR, USD, Gold, Silver, Custom) | USD only | USD, EUR, Gold (limited) | Major cryptos only |

| Liquidity Requirements | £0 (burn-and-mint) | N/A (single chain) | N/A (single chain) | 2-4x transaction value |

| Bridging Mechanism | Burn-and-mint (atomic) | Native issuance per chain | Native issuance per chain | Lock-and-mint (requires liquidity) |

| Bridge Time | 10-15 seconds | N/A (use bridges: 15-30 min) | N/A (use bridges: 15-30 min) | 15-30 minutes |

| Slippage | 0% (deterministic mint) | N/A (requires bridge with slippage) | N/A (requires bridge with slippage) | 0.1-3% depending on liquidity |

| Multi-Chain Support | 15+ chains (unified standard) | 15+ chains (fragmented liquidity) | 10+ chains (fragmented liquidity) | Varies (5-50 chains) |

| Cross-Asset FX | Yes (EUR ↔ USD ↔ Gold ↔ Custom) | No (single asset per bridge) | ||

| Reserve Backing | 1:1 reserves (audited, transparent) | 1:1 reserves (audited monthly) | 1:1 reserves (quarterly attestations) | N/A (crypto-to-crypto) |

| Regulatory Approach | EU MiCA compliant | US regulated (state licenses) | Offshore (limited transparency) | Unregulated |

| Custom Asset Classes | Yes (gold, silver, commodities, custom) | Gold only (separate token) | No (crypto only) |

Data accurate as of 2/4/2026. Competitor features may vary.

What Our Customers Say

Real feedback from businesses transforming their payment operations

Michael Rodriguez

Founder & CEO, BCIFGOLD

Alex Kim

CTO, ChainBridge Finance

David Larsson

Head of Blockchain, Nordic Finance AB

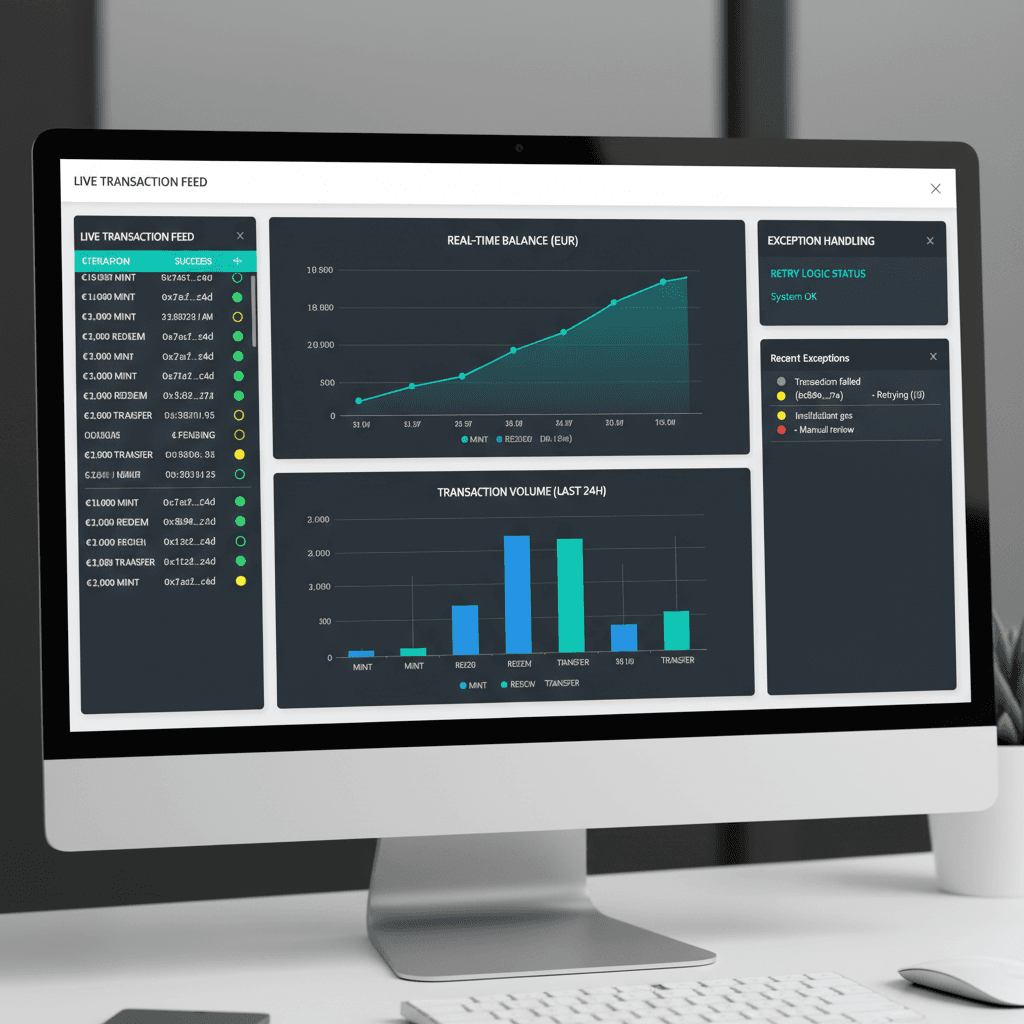

Watch every transaction as it happens

Track mint, redeem, and transfer operations in real time. Exceptions and retries are visible; exports line up with finance for a clean close.

Live Transaction Feed

Monitor all mint, redeem, and transfer operations as they occur with sub-second updates.

Exception Handling

Automatic retry logic with full visibility into failed transactions and resolution status.

Finance Exports

Export transaction data in formats that align with accounting systems for seamless reconciliation.

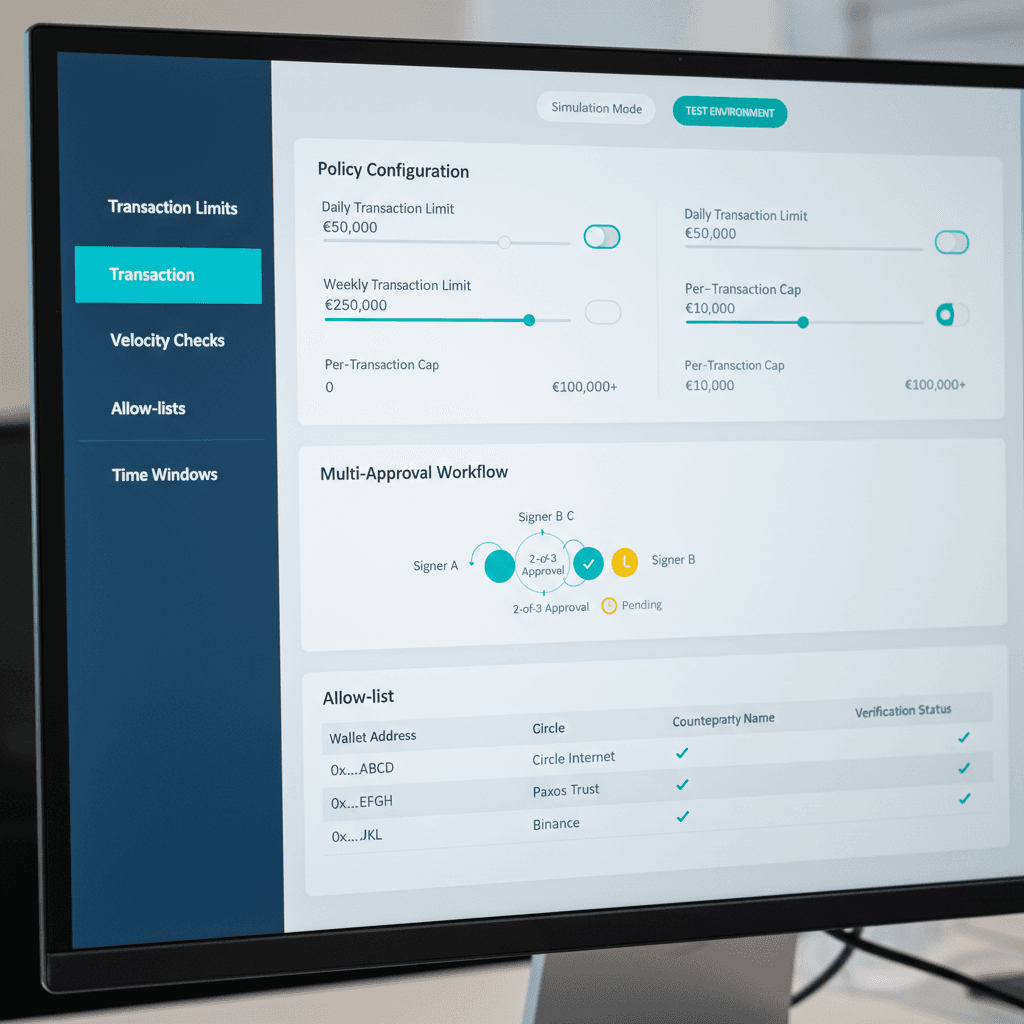

Enforce your rules at runtime

Set limits, allow-lists, and time windows that are checked automatically. Require multi-approval for sensitive actions and simulate changes before go-live.

Automated Limits

Configure transaction limits, velocity checks, and allow-list enforcement at the protocol level.

Multi-Approval Workflows

Require multiple signers for sensitive operations like policy changes or large mints.

Simulation Mode

Test policy changes in a safe environment before deploying to production.

Enterprise-grade stablecoin infrastructure

Built for compliance, transparency, and scale

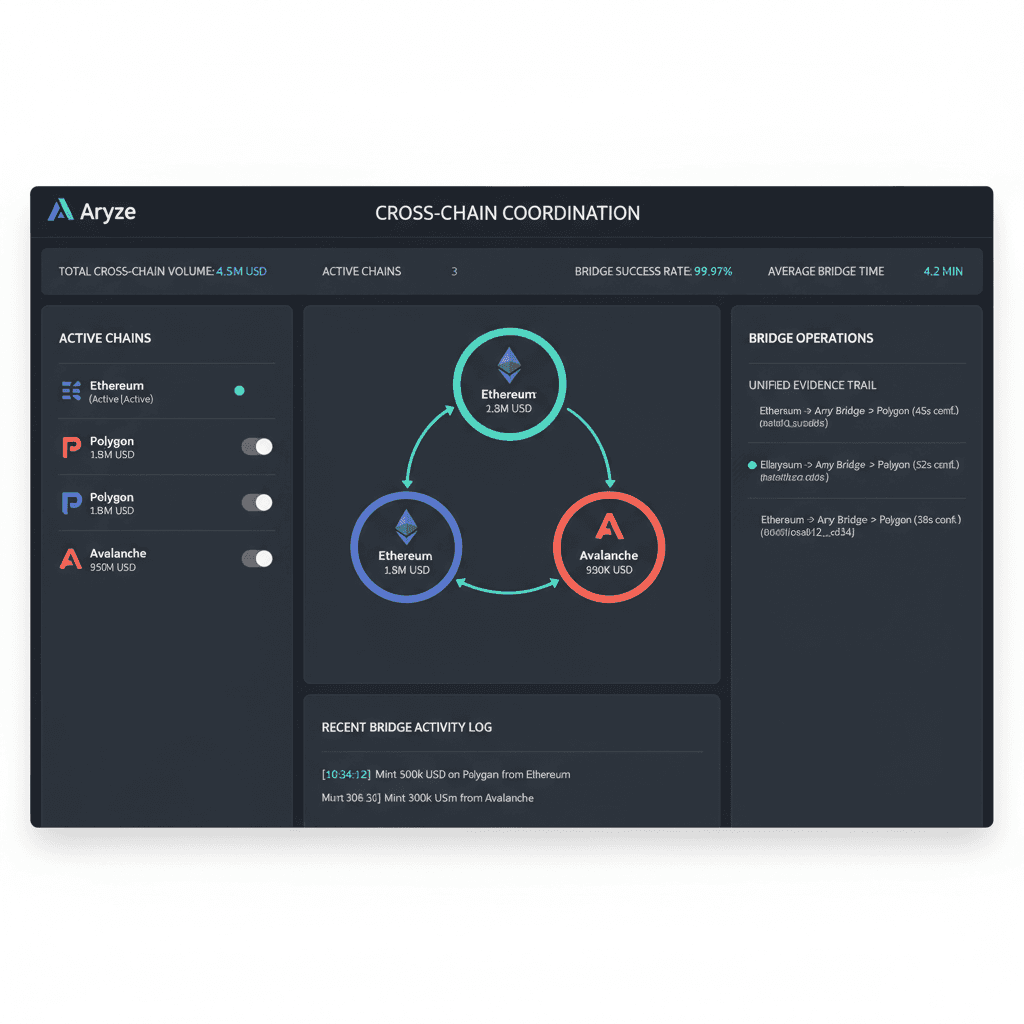

Distribute without wrapped-token risk

Deploy across supported networks using burn-and-mint patterns. One evidence trail ties every hop together, maintaining full transparency across chains.

Burn-and-Mint Bridges

Native tokens on every chain, eliminating wrapped token risks and maintaining 1:1 backing.

Unified Evidence Trail

Every cross-chain transfer creates an immutable record linking source and destination.

Multi-Network Support

Deploy on Ethereum, Polygon, Avalanche, and other supported networks from a single dashboard.

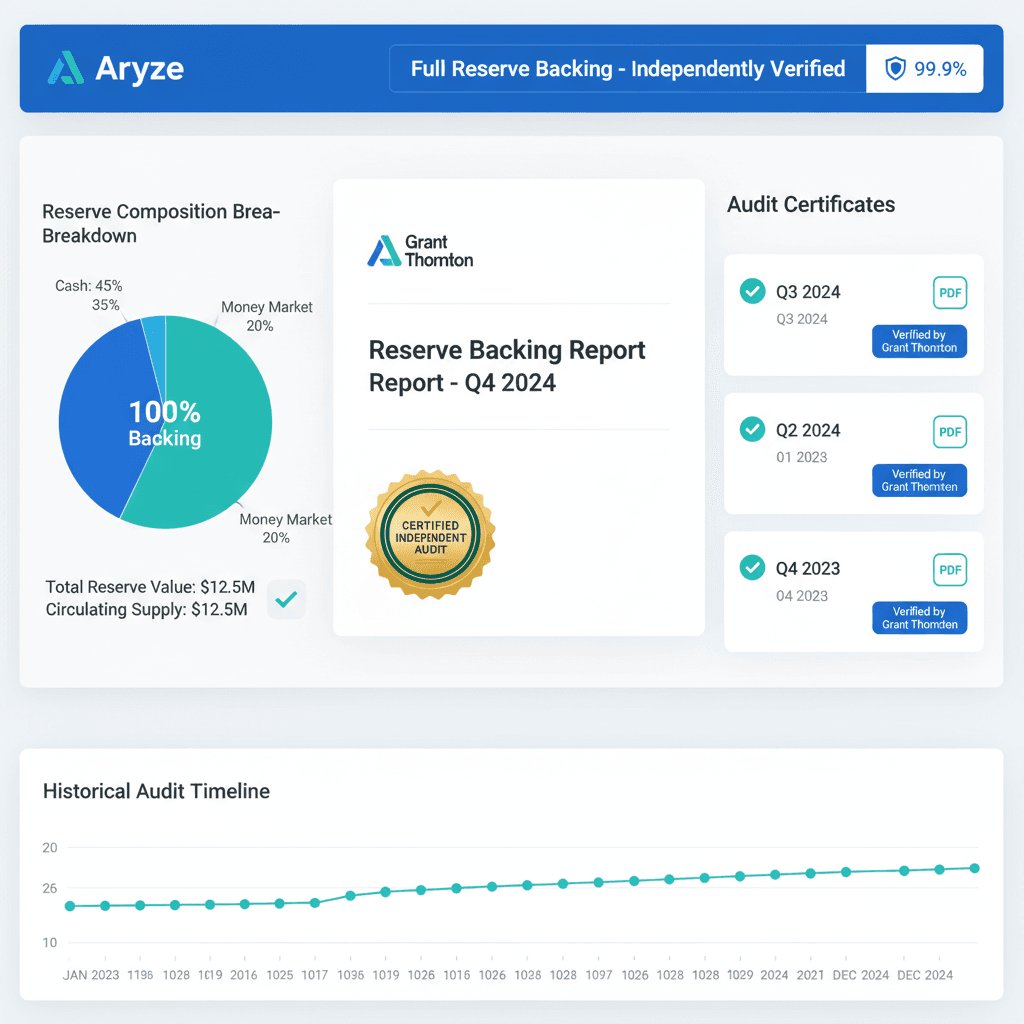

Publish proof your stakeholders can verify

Generate downloadable transparency reports with reserve attestations and on-chain references. Grant Thornton conducts independent monthly audits with full access to accounts and issuances, publishing attestation reports for complete transparency.

Transparency Reports

Automated generation of comprehensive reports showing reserves, issuance, and on-chain state.

Reserve Attestations

Real-time proof of reserves with cryptographic verification and third-party attestations.

Monthly Audits

Independent audits by Grant Thornton included with every white-label deployment.

Ready to build your stablecoin?

Start unbranded to validate policy and reporting; go white-label when stakeholders are satisfied.

Trusted by financial institutions worldwide

Leading organizations rely on Aryze to power their stablecoin infrastructure

"Aryze's white-label platform allowed us to launch our stablecoin in months, not years. The policy engine and real-time monitoring gave our regulators the confidence they needed."

"The transparency reports and Grant Thornton audits were crucial for our institutional clients. We maintain full control while Aryze handles the complex multi-chain infrastructure."

"Cross-chain deployment without wrapped tokens was a game-changer. Our users can move seamlessly across networks while we maintain a single source of truth for reserves."

Contact

Get answers to common questions about our programmable settlement platform

Insights & Resources

Deep dives into stablecoin technology, compliance, and strategy

Building Trust Through Transparency

How real-time reserve attestations and independent audits create confidence in digital assets for enterprise stakeholders.

Multi-Chain Architecture Patterns

Technical deep-dive into burn-and-mint patterns for safe cross-chain stablecoin distribution without wrapped token risks.

Policy-First Stablecoin Design

Why embedding governance rules at the infrastructure layer matters for enterprise adoption and regulatory compliance.

The Future of Programmable Money

Exploring how smart contract-based policies enable new models for corporate treasury, settlement, and financial operations.

Ready to launch your stablecoin?

Schedule a consultation with our team to discuss your requirements and see how our white-label platform can accelerate your go-to-market.