Anything to Anything.Open Banking + Blockchain.

Combined infrastructure for cross-border payments and cross-chain settlement. Account-to-account via open banking. Burn-and-mint bridging (typically 10-15 seconds). Cross-asset FX. All in one flow.

Your LPs provide liquidity and pricing. We orchestrate the rest: policy enforcement, multi-hop routing, 24/7 settlement, and unified audit trails.

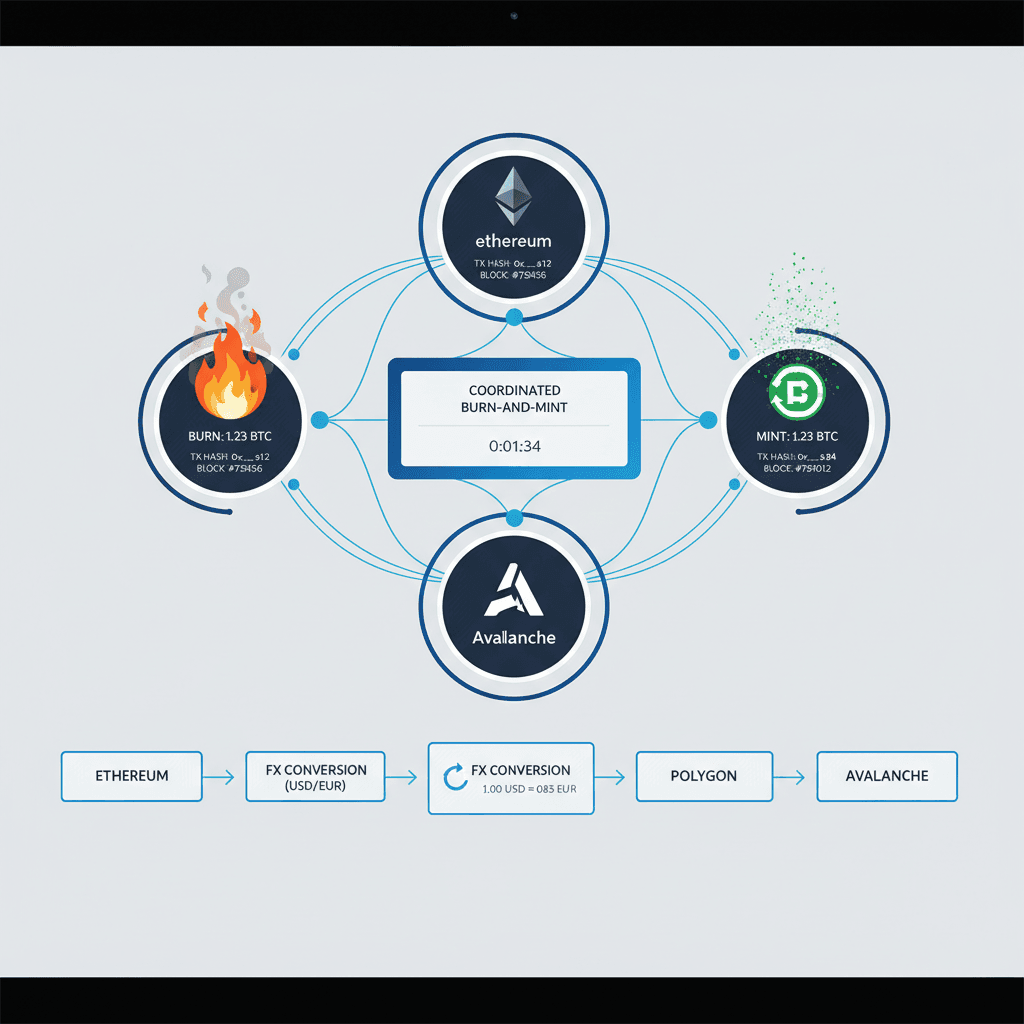

Cross-chain without wrapped copies

Burn on the first network, mint on the second - no wrapped duplicates. Each move leaves an on-chain reference you can verify and export.

FX with control

Request a quote, apply your rules, confirm, and settle where you already trade. We orchestrate the flow and keep the evidence; your LPs price and execute.

Try It Yourself

See how multi-hop routing finds the optimal path for cross-currency transfers in real-time.

Traditional

Time: 4 days

Spread: 3.5%

ARYZE

Time: 15 seconds

Spread: 0.1%

Want to integrate ARYZE's burn-and-mint infrastructure?

Contact SalesBuilt for Your Business

Orchestrate FX across any asset, any chain, any time with 15-second settlement and best execution.

FX Orchestration Results

Modern cross-border payment infrastructure

Days → seconds

Lower fees

Always on

Global coverage

ARYZE vs Cross-Border Solutions

See how 15-second settlement compares to 3-5 day wires

| Feature | ARYZE | Wise | SWIFT/Banks | Multi-hop Bridges |

|---|---|---|---|---|

| Settlement Time | 10-15 seconds | 1-2 days | 3-5 days | 30 min - 2 hours |

| Operating Hours | 24/7/365 | Business hours (delays on weekends) | Business hours only | 24/7 |

| Cost Structure | Flat fee + transparent FX | 0.5-2% + FX markup | £25-50 + hidden FX markup | Gas fees + slippage per hop |

| FX Markup | 0.1-0.3% (transparent) | 0.35-1% above mid-market | 2-5% hidden in rate | 0.5-3% per swap |

| Cross-Border Support | 140+ countries (instant) | 80+ countries (1-2 day delays) | 200+ countries (3-5 days) | Global (but complex routing) |

| Policy Controls | Programmable (rules engine) | Basic limits | Manual approval workflows | None |

| Audit Trail | Complete (blockchain + banking) | Good (centralized ledger) | Limited (MT messages) | Blockchain only (no fiat) |

| Multi-Hop Routing | Yes (automated optimization) | No (single corridor) | Yes (manual, slow) | Yes (manual routing required) |

| Blockchain + Banking | Yes (hybrid rails) | Banking only | Banking only | Blockchain only |

| Real-Time Visibility | Yes (live tracking every step) | Limited (status updates) | No (opaque) | Partial (on-chain only) |

Data accurate as of 2/4/2026. Competitor features may vary.

What Our Customers Say

Real feedback from businesses transforming their payment operations

David Okoye

COO, GlobalRemit

Priya Sharma

Head of Operations, InstantSend

Robert Chang

Treasury Director, GlobalTech Corp

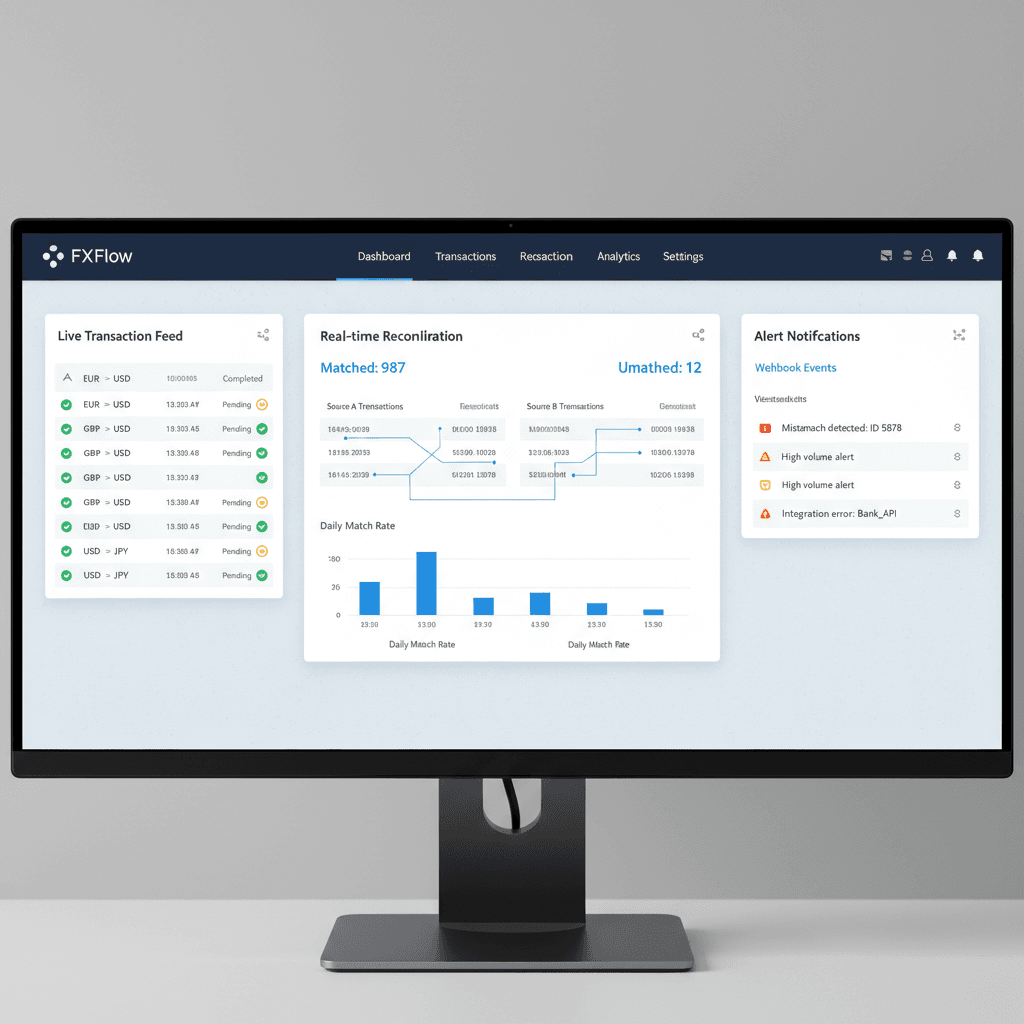

Real-time view of every step

Watch requests, approvals, quotes, burns/mints, fills and settlements as they happen. Alerts and webhooks surface exceptions immediately so ops and finance stay in lockstep from initiation to reconciliation.

Live Transaction Tracking

Monitor every cross-chain move and FX conversion in real-time with sub-second updates and status changes.

Exception Alerts

Instant notifications via webhooks when approvals are needed, quotes expire, or transactions fail retry logic.

Reconciliation Dashboard

Unified view linking operational events to financial records, ensuring ops and finance teams stay aligned.

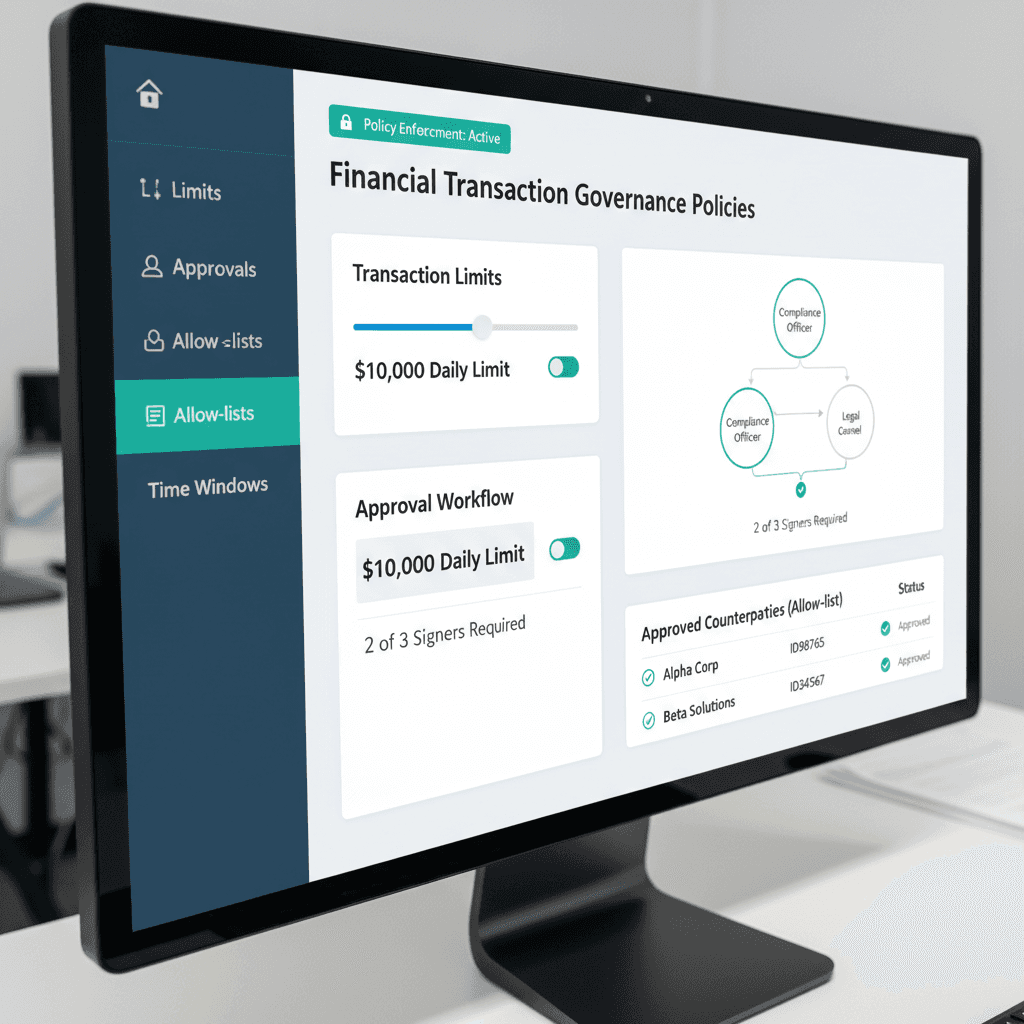

Your rules, enforced automatically

Set limits, approvals, allow-lists and time windows once. We check them on every cross-chain move and every conversion, so approved actions go through and risky ones don't.

Policy Engine

Configure transaction limits, velocity checks, counterparty allow-lists and time-based restrictions at the infrastructure level.

Multi-Approval Workflows

Require multiple signers for sensitive operations like large conversions or cross-chain moves above thresholds.

Allow-list Management

Maintain approved counterparties, wallets and liquidity providers with automatic enforcement on every transaction.

Cross-chain and conversions, coordinated

For cross-chain, we orchestrate burn-and-mint - no wrapped IOUs. For conversions, your LPs provide prices and execute. When you need both, reForge routes the combined hop with policies and confirmations baked in. Fewer handoffs. Fewer surprises.

Burn-and-Mint Orchestration

Native tokens on every chain with coordinated burn/mint operations, eliminating wrapped token complexity and risks.

Multi-Hop Routing

Combine cross-chain moves with FX conversions in a single atomic flow, reducing settlement time and capital requirements.

LP Integration

Connect your existing liquidity providers for pricing and execution while reForge handles orchestration and compliance.

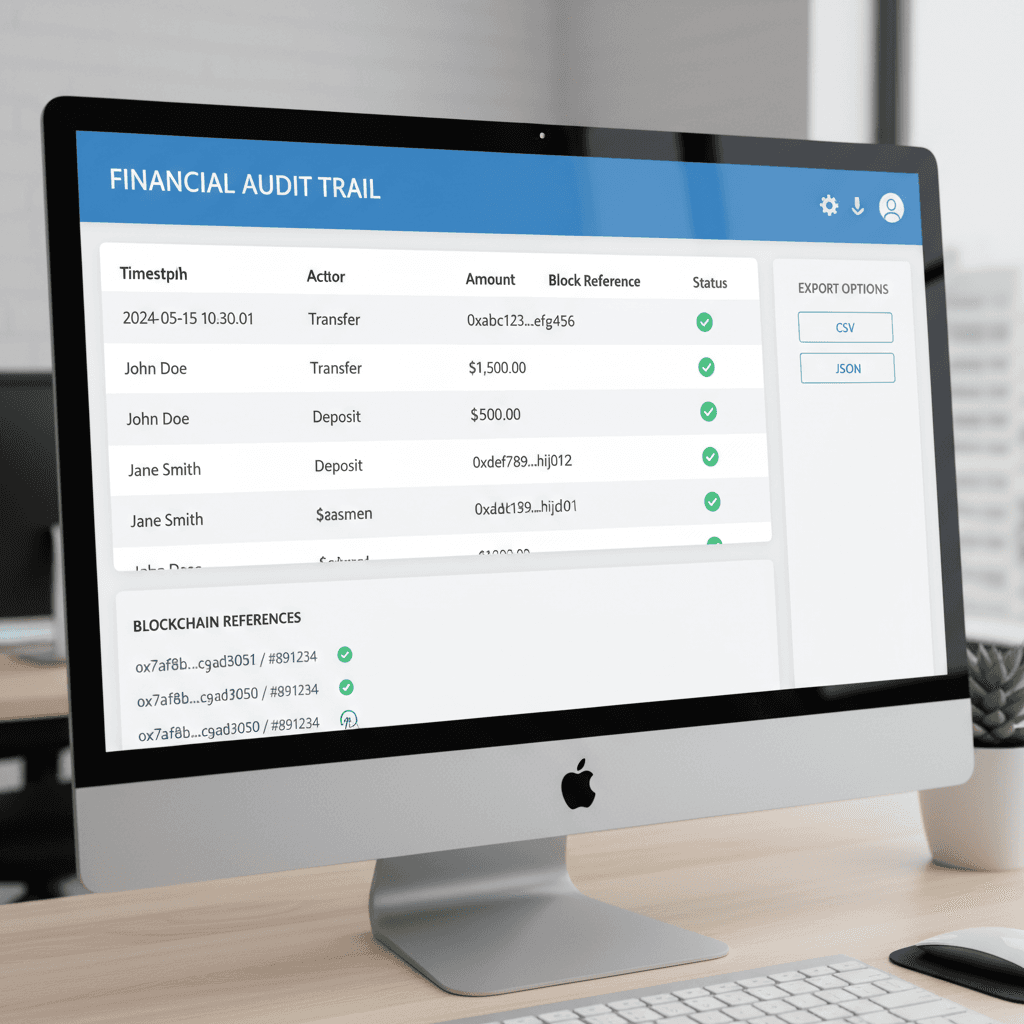

One record finance can trust

Every step lands in a unified log with the who, what, where and block/bank references. Export CSV/JSON or stream events so books match operations - no archaeology.

Unified Audit Log

Complete trail of every request, approval, quote, execution and settlement with timestamps and actor attribution.

Export Capabilities

Download transaction data in CSV/JSON formats compatible with accounting systems and compliance reporting tools.

Blockchain References

On-chain transaction hashes and block numbers linked to every cross-chain move for cryptographic verification.

Unlock seamless cross-chain financial infrastructure

Coordinate assets across supported networks without wrapped tokens. Burn-and-mint connectors, policy checks and a blockchain reference for every hop give you clear ownership and a clean audit trail.

Ready to transform your financial infrastructure?

Spend 30 minutes with a solutions engineer. We'll map your flows and show where you can cut pre-funding, reduce exceptions and keep the close clean.

Trusted by financial institutions worldwide

Leading organizations rely on reForge to power their cross-border infrastructure

"reForge cut our settlement time from 3 days to minutes. The burn-and-mint flow eliminated wrapped token risks while the policy engine gave us the control our CFO demanded."

"We reduced pre-funding requirements by 60% and exceptions dropped to near-zero. The real-time visibility means finance and ops finally speak the same language."

"The LP integration was seamless. We kept our existing pricing relationships while reForge handled orchestration, approvals and audit trails - exactly what we needed."

Contact

Get answers to common questions about our FX orchestration platform

Insights & Resources

Deep dives into FX orchestration, settlement technology, and compliance

Reducing Pre-Funding in Cross-Border Payments

How coordinated settlement flows and real-time policy checks eliminate the need for capital sitting idle across multiple corridors.

Beyond Wrapped Tokens: Native Cross-Chain Assets

Why burn-and-mint patterns provide cleaner ownership and simpler reconciliation than bridged or wrapped token alternatives.

FX Orchestration for Regulated Institutions

Meeting regulatory requirements with multi-approval workflows, real-time monitoring and comprehensive audit trails for every conversion.

The Economics of Settlement Orchestration

How reducing hops, exceptions and working capital requirements transforms the unit economics of cross-border financial products.

Ready to streamline your settlement flows?

Join financial institutions that have reduced hops, cut exceptions and improved capital efficiency with reForge.