£1 Fees vs £10,000.Onboard High-Risk Merchants.

Transparent, predictable payment processing. Flat fees instead of percentages.

Account-to-account instant payments. 24/7 settlement orchestration. Native on/off ramp for stablecoins. Powered by Mastercard.

Try It Yourself

Experience the cost savings and speed of ARYZE's Open Finance platform with a live simulation.

Traditional (7%)

£700.00

ARYZE (flat fee)

£1.00

You save: £699.00

99.9% cost reduction

When Others Say No, We Say Yes

Traditional payment processors reject high-risk industries or charge predatory fees. ARYZE provides open banking provisioning for merchants others won't touch.

Gaming & Gambling

Common Challenges:

- • High chargeback rates

- • 10%+ fees standard

- • Limited provider options

ARYZE Solution:

Flat-fee pricing + chargeback management

Adult Content

Common Challenges:

- • Banks refuse service

- • Processor terminations

- • Reputational risk

ARYZE Solution:

Open banking provisioning without judgment

Crypto & Web3

Common Challenges:

- • Regulatory uncertainty

- • Traditional banks say no

- • High operational costs

ARYZE Solution:

Native crypto + fiat infrastructure

Nutraceuticals

Common Challenges:

- • Product liability concerns

- • High monthly fees

- • Account freezes

ARYZE Solution:

Stable, predictable flat-fee model

Why High-Risk Merchants Choose Us

- No arbitrary account closures

- Transparent flat-fee pricing

- Dedicated high-risk underwriting team

- Fast onboarding (days, not months)

- 24/7 settlement capability

- Native stablecoin on/off ramp

Dedicated High-Risk Team

Our underwriting team specializes in high-risk industries. We understand your business model, regulatory challenges, and operational needs. No generic rejection letters here.

Response within 24 hours • Onboarding in days, not months

Powered by Mastercard Open Banking: Enterprise-grade infrastructure with ARYZE's high-risk expertise.

Built for Traditional Businesses

Modern payment rails that reduce costs, increase speed, and eliminate complexity for traditional businesses.

SaaS & E-Commerce Results

Trusted by modern digital businesses

2-3% → under 1%

Not 9-5 M-F

RESTful APIs

Enterprise SLA

ARYZE vs Payment Processors

See how flat-fee pricing compares to traditional payment processors

| Feature | ARYZE | Stripe | PayPal | Traditional Banks |

|---|---|---|---|---|

| Pricing Model | £1 flat fee per transaction | 2.9% + £0.30 per transaction | 2.9% + £0.30 per transaction | 7-10% of transaction value |

| High-Risk Merchants Accepted | Limited | |||

| Settlement Time | 10-15 seconds | 2-7 days | 1-3 days | 3-5 days |

| Geographic Coverage | Global (140+ countries) | 46 countries | 200+ countries (limited features) | Domestic focus |

| Account Freezes | No arbitrary freezes | Risk-based freezes common | Frequent holds (180 days) | Compliance-based freezes |

| Integration Complexity | Simple API (2-3 days) | Moderate (1-2 weeks) | Simple (3-5 days) | Complex (3-6 months) |

| Chargebacks | Irreversible (blockchain-based) | High chargeback risk | Very high chargeback risk | Chargeback disputes (90-180 days) |

| Operating Hours | 24/7/365 | 24/7 (settlement delays weekends) | 24/7 (settlement delays weekends) | Business hours only |

| Minimum Volume | No minimum | No minimum (but fees eat small tx) | No minimum (but fees eat small tx) | £10,000+ monthly typically |

| Crypto Support | Native crypto on/off ramp | Crypto buy/sell only (no withdrawals) |

Data accurate as of 2/4/2026. Competitor features may vary.

What Our Customers Say

Real feedback from businesses transforming their payment operations

Emma Thompson

Finance Manager, TechFlow SaaS

Sarah Chen

CFO, Victory Gaming

Marcus Rodriguez

Operations Director, Global iGaming Ltd

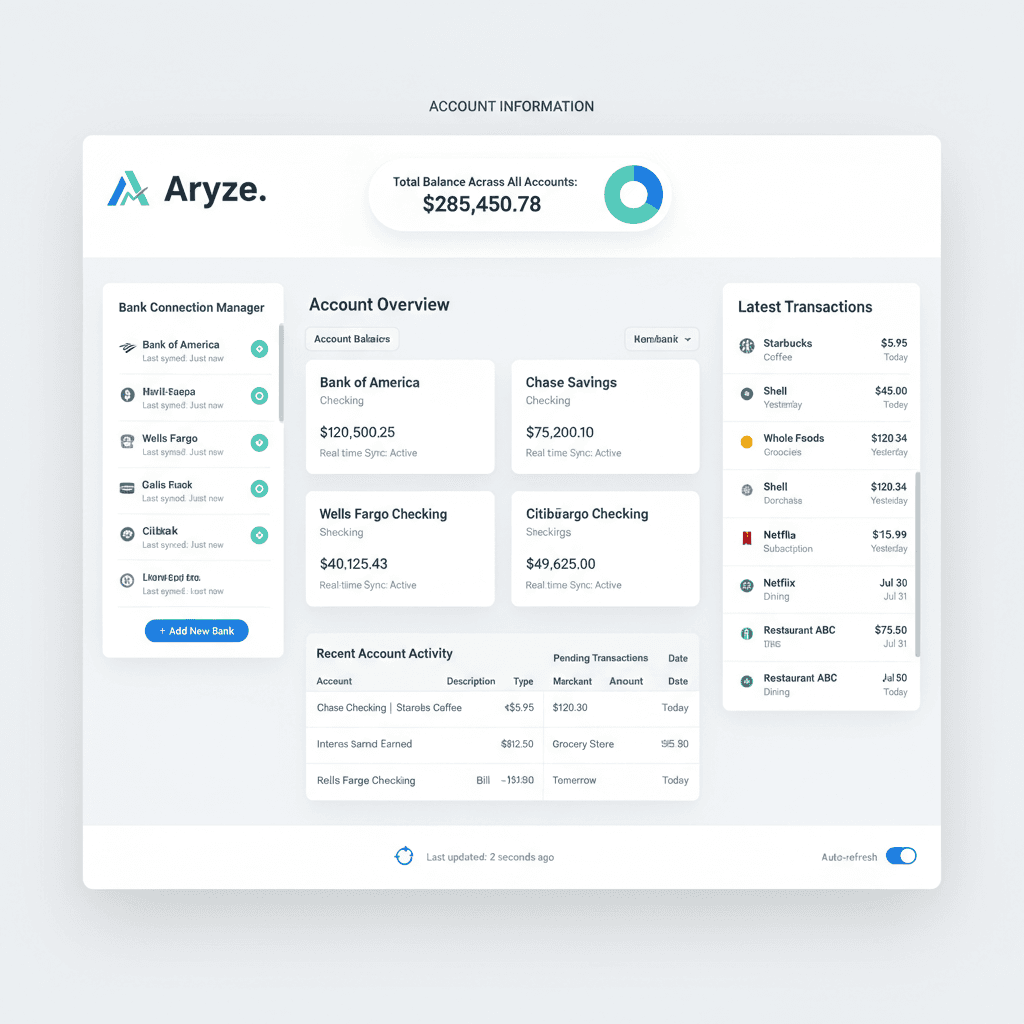

Real-time access to account data

Connect to any European bank and retrieve balances, transactions, and account details in real-time.

Live Balance Updates

Get real-time account balances across all connected accounts with sub-second latency.

Transaction History

Access complete transaction history with rich metadata, categorization, and search capabilities.

Automatic Sync

Set up webhooks to receive instant notifications when account data changes.

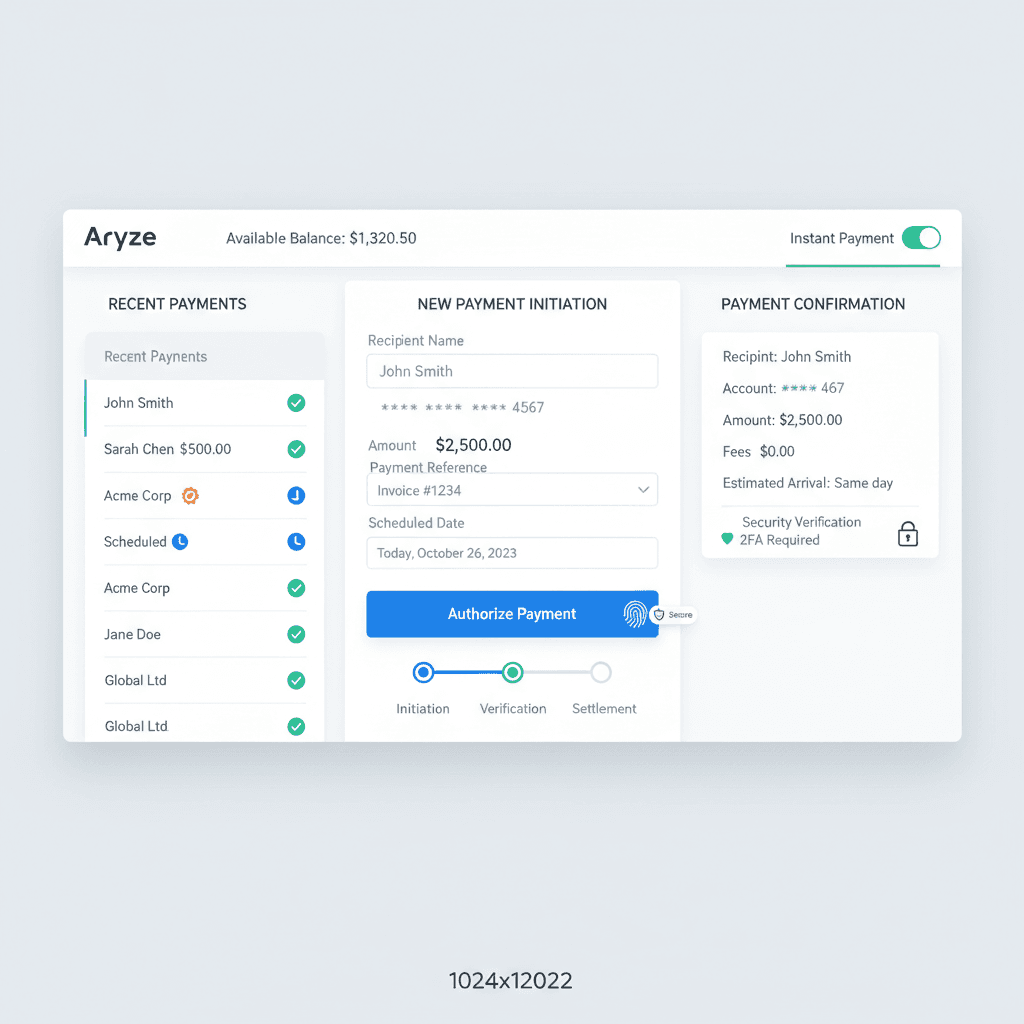

Instant bank-to-bank payments

Enable customers to make secure payments directly from their bank accounts without cards.

Instant Settlement

Process payments in seconds with immediate confirmation and settlement tracking.

SCA Compliant

Built-in Strong Customer Authentication meeting all PSD2 security requirements.

Payment Status

Real-time payment status updates from initiation through completion or failure.

Built for the modern financial ecosystem

Our infrastructure is trusted by fintech leaders across Europe

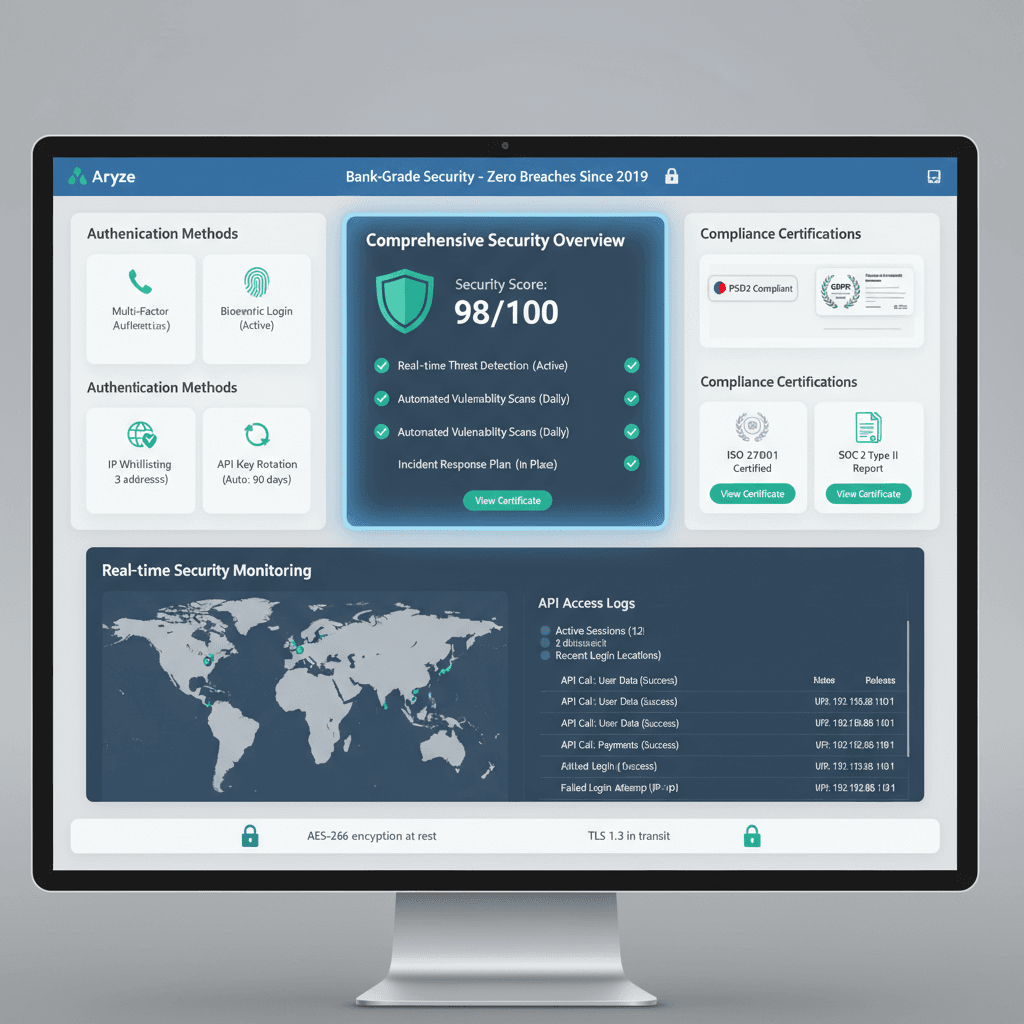

Enterprise-grade security built in

Bank-level security and full regulatory compliance, so you can focus on your product.

AISP & PISP Licensed

Fully licensed and regulated under PSD2 across all European markets.

Zero Credential Storage

We never store banking credentials. All authentication happens directly with banks.

SOC 2 Certified

Regular security audits and compliance certifications you can trust.

Built for developers, by developers

Modern APIs, comprehensive docs, and powerful tools to get you from idea to production fast.

REST & Webhooks

Clean REST APIs with webhook support for real-time events and data updates.

Sandbox Environment

Full-featured sandbox with test banks for risk-free development and testing.

SDKs & Libraries

Official SDKs for Node.js, Python, and more, with detailed code examples.

Ready to integrate Open Finance?

Join leading fintechs using Aryze Open Finance for real-time banking connectivity. Get started in minutes with our comprehensive API and sandbox environment.

Frequently Asked Questions

Learn more about Aryze Open Finance, our compliance standards, and how to get started with our banking APIs.

Latest Insights

Stay updated on Open Finance trends, technical guides, and industry news

The Future of Open Banking in Europe

Exploring how PSD3 and Open Finance will reshape the financial landscape and create new opportunities for innovation.

Building Secure Payment Flows with Open Finance

Best practices for implementing payment initiation services that meet SCA requirements and deliver great UX.

Real-time Account Data: Use Cases and Implementation

How leading fintechs are leveraging real-time banking data to create innovative financial products.